CRAFT request for pre-proposals

CRAFT is seeking new pre-proposals for fintech-related research projects.

>> Pre-Proposal Submission Site

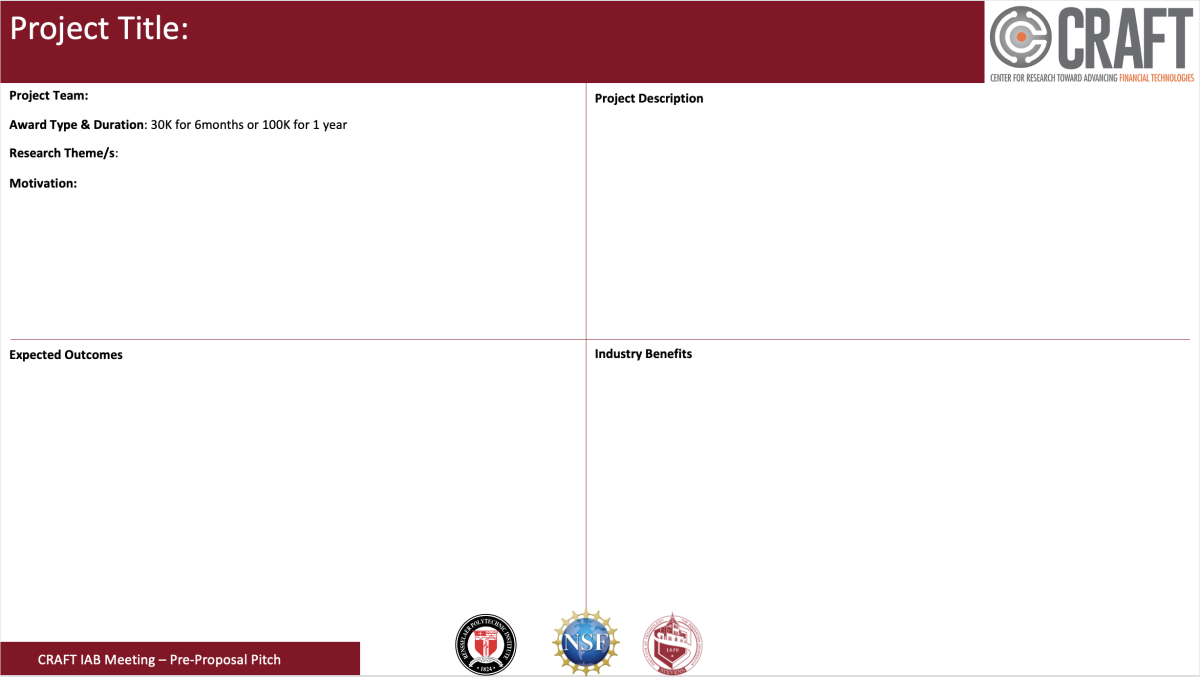

Download instructions here and download the PPT Pitch Slide here.

Important Dates

9/8/25 – Pre-proposals due

Week of 9/15/25 –Lightning Round Presentations with IAB members

9/26/25 – Vote by IAB Members on pre-proposals due

Week of 9/29/25 - ALT finalizes pre-proposal selection, Affiliated faculty are notified of proposal status & IAB Feedback is shared

10/10/25 – Full proposals are due via Airtable

10/17/25 – Proposal PPT, Summary Slide Due, Proposal Video Due

10/23/25 to 10/24/25 – Fall 2025 IAB Meeting at Stevens Institute of Technology

Background

Financial technology (Fintech) firms aim to modernize many traditional financial services through efficiency improvements realized through operational, quantitative modeling, and delivery automation. Academic institutions have recently launched focused research and education initiatives in the Fintech area. This included the offering of Fintech certification and degree programs aimed at bachelors, masters, and research oriented doctoral students working in the areas of quantitative finance, computer science, information systems, and computer engineering, among other disciplines. These students are trained by faculty specialists in research areas that include, but are not limited to, human-centered computing, explainable AI, risk modeling, distributed computing, smart contracts, information security, quantum computing, decentralized exchange design, and machine learning finance applications. Given the historical importance of the computational sciences driving financial innovation, the growing development and integration of these technologies in the Fintech area, a collaborative, interdisciplinary consortium of university and industry partners focused on Fintech research and innovation can make a great impact.

Center for Research toward Advancing Financial Technologies (CRAFT), a national collaborative research center at Stevens Institute of Technology (Stevens) and Rensselaer Polytechnic Institute (RPI) and co-funded by the National Science Foundation (NSF), focuses on the advancement of innovative financial technology research with practical applications for industry partners. The NSF created the Industry/University Cooperative Research Center model over forty years ago to focus research attention and build institutional support related to critical fields of science and technology. The I/UCRC model was designed around three primary objectives:

Conduct high-quality, high-impact research to meet shared needs of key industry constituencies (in this case, the financial services industry)

Enhance U.S. global leadership in driving innovative technology development (in this case, Fintech)

Recruit, mentor and develop a diverse, high-tech, exceptionally skilled workforce.

CRAFT is the first I/UCRC focusing on Fintech research and innovation to bring together academic and industry participants, as well as representatives from all levels of government, and support the agenda of advanced research projects related to the Fintech challenges of the financial services industry.

This call for proposals is intended to solicit the second year of research projects from CRAFT affiliated faculty members. The proposals submitted in response to the CfP will be presented to the CRAFT Industry Advisory Board (IAB) at the semi-annual fall and spring meeting for feedback. A formal project selection process will be followed by the IAB and CRAFT Academic Leadership Team (ALT) for funding consideration.

Research Areas

The financial services industry is presently undergoing considerable change due to the development of new technologically focused products and services. The understanding of these innovations requires multidisciplinary approaches from the perspective of industry, societal and government policies. CRAFT is dedicated to supporting new research in the Fintech area that focuses on the broad areas of finance and economics, business, management, law and regulation, risk analytics, ethical AI, behavioral and social sciences. These multidisciplinary research projects should aim to realize the following values:

Need for explainable, fair, and accessible financial technologies; trust is critical to the business leaders we surveyed for capitalizing on the opportunities from emerging technologies.

Need to be resilient, accountable and socially responsible; the promise of Fintech democratizing finance must be realized.

Need to address sustainability, climate impact, and green finance issues to support sustainable economic growth.

Need for cooperation with financial regulation. This is going to be the case since many technology-induced transformations will result in the need for new regulations and business imperatives, which will greatly benefit from interdisciplinary investigations.

Examples of the research topics include but are not limited to the following:

Applications of machine learning and artificial intelligence of different kinds in financial information processing and financial decision making.

Cryptocurrency and Blockchain technology challenges and innovations. Smart contracts utilization in financial services.

The design and scaling of decentralized exchanges including automated market makers and case studies in extreme market events for securities traded on these exchanges such as the recent Terra collapse.

Generative AI - solving problems for institutional investors via trust, transparency, explainability, use cases on efficiency and communication, domain specific models that build on foundation models, banking fraud protection…

Open banking concepts using blockchains for third-parties’ access to bank data to build applications that create a connected network of financial institutions and third-party providers. An example is the all-in-one money management tool Mint.

Quantum computing and communications in capital markets, corporate finance, portfolio management, and encryption-related activities.

Insurtech innovations to simplify and streamline the insurance industry. This may include peer-to-peer insurance platform development, using machine learning techniques to more accurately estimate accident risk and associated premium amounts, or automating aspects of the claims and payment process.

Regtech innovations to help financial service firms meet industry compliance rules, especially those covering Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to fight fraud.

Robo-advisors algorithmic advances, such as Betterment and Wealthfront, to automate investment advisory processes to lower its cost and increase accessibility.

Unbanked/underbanked services that seek to serve individuals who are ignored or underserved by traditional banks or mainstream financial services companies.

Cybersecurity solutions to fight cybercrime and the decentralized storage of data.

New developments in Fintech ethics, legal, and regulatory topics including how to construct cryptocurrency regulation that is minimally burdensome but protects token holders from fraudulent practices.

Proposal Timeline

9/8/25 – Pre-proposals due

Week of 9/15/25 –Lightning Round Presentations with IAB members

9/26/25 – Vote by IAB Members on pre-proposals due

Week of 9/29/25 - ALT finalizes pre-proposal selection, Affiliated faculty are notified of proposal status & IAB Feedback is shared

10/10/25 – Full proposals are due via Airtable

10/17/25 – Proposal PPT, Summary Slide Due, Proposal Video Due

10/23/25 to 10/24/25 – Fall 2025 IAB Meeting at Stevens Institute of Technology

Prepration Instructions

Please complete the Project Pre-proposal pitch slide template which you can download here. (Example of the slide is below)

Pre-Proposal Due Date(s) [due by 5 p.m. ET]

January 19 (for Spring IAB meeting)

Proposal Timeline

January 19 – Pre-proposals due

First week of February - lightning talks with IAB member

February 16 – Full proposals due via Airtable

Week of February 19 – ALT meets to select proposals for IAB presentation

March 8 – Proposal PPT & Summary Slide Due

March 15 – Proposal Video Due

March 28-29 – Spring 20234 IAB Meeting

Selection Process

The process of evaluating and selecting pre-proposals will generally be governed by the following process:

Prospective PIs will prepare and submit (via Airtable) their pre-proposal pitch slide PPT in advance of the “lightning rounds” zoom call with IAB members, making them available to the Center Director for sharing with IAB members

Pre-proposals will be presented to industry members during the “lightning rounds” zoom call prior to IAB Meetings as a 5-min “shark tank style” pitch, focusing on outcomes and industry value. It may also be presented on an ad hoc basis at other times

After pre-proposals presentations are completed, IAB members will consider each as “go” or “no-go”

Pre-proposals with “go” status will be asked to complete a full proposal using the website (found here) by the full proposal deadline

A selection of full proposals will be made by the ALT to be formally presented to the IAB at the IAB meeting

The IAB will vote on proposals using tools and according to procedures defined with help of the NSF reflecting “best practices” for I/UCRCs. All Members will vote based on their level of membership (e.g., Full, Associate)

The projects which receive support from the IAB will be referred to the ALT

The ALT will review and determine which projects will be funded for the following year.

Decisions and Reports

The evaluation of prospective research projects will be carried out jointly by the ALT and the IAB. The ALT will take measures to ensure that projects (a) are appropriately precompetitive in nature and constitute basic research, (b) reflect fairly the diversity of interests and applications represented by the Members of the IAB, and (3) do not duplicate existing research efforts funded by other sources which may be ongoing at the Sites.

Research Project formats will include: (a) Standard Projects – 1 year in length, renewable with approval of a follow-on proposal; and (b) Pilot projects – short (3-6 month) projects to evaluate a topic for possible further research and conversion to a proposal for a Standard.

Final decisions to authorize specific projects is the responsibility of the ALT, after considering recommendations of the IAB.

Deliverables for each CRAFT research project will, at a minimum, include a project report, with data and full description of inventions. Additional deliverables may include: a) A White Paper; b) Academic Conference Presentations; and c) An article submitted for peer-reviewed publication.

If you have any questions, please feel free to reach out to Dr. Steve Yang (steve.yang@stevens.edu), Dr. Mohammed J. Zaki (zaki@cs.rpi.edu), Dr. George Calhoun (gcalhoun@stevens.edu), or Dr. Zachary Feinstein (zfeinste@stevens.edu).

If you are not currently an affiliated faculty member with CRAFT, please contact one of the site directors Dr. Steve Yang or Dr. Mohammed J. Zaki. Please note that PIs need to be CRAFT affiliated faculty members to submit a proposal, however this is not required for project’s co-PI(s).